pqepny.site

Overview

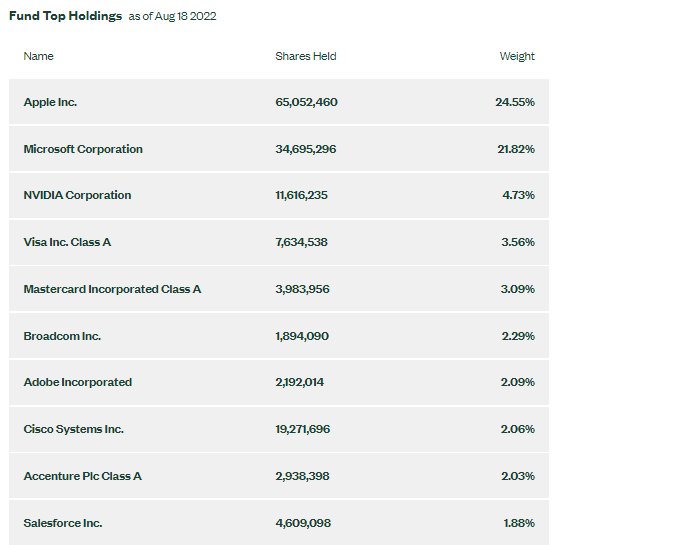

Xlk Etf Fees

Find the latest The Technology Select Sector SPDR Fund (XLK) stock quote, history, news and other vital information to help you with your stock trading and. XLK ETF in-depth analysis and real-time data such as the investment strategy, characteristics, ETF Facts, price, exposure, AuM, Expense Ratio, and more. XLK is listed as: Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan rates from % to %. Gemini is well-suited for crypto. Technology Select Sector SPDR Fund (XLK) ETF Stock Forecast, Price costs, management fees, performance fees or expenses, if applicable. Please. An easy way to get SPDR Select Sector Fund - Technology real-time prices. View live XLK stock fund chart, financials, and market news. Fund Details ; Fund Type. Sector Equity ; Issuer. SPDR State Street Global Advisors ; Inception. 12/16/ ; Expense Ratio. % ; AUM. $B. XLK | A complete Technology Select Sector SPDR ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. The Technology Select Sector SPDR® ETF (XLK). + (+%) USD | NYSEARCA | Aug 23, + (+%) After-Hours: Switch to. XLK tracks an index of S&P technology stocks. XLK was the first to launch in this space, as such it offers a more narrow focus on the US technology segment. Find the latest The Technology Select Sector SPDR Fund (XLK) stock quote, history, news and other vital information to help you with your stock trading and. XLK ETF in-depth analysis and real-time data such as the investment strategy, characteristics, ETF Facts, price, exposure, AuM, Expense Ratio, and more. XLK is listed as: Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan rates from % to %. Gemini is well-suited for crypto. Technology Select Sector SPDR Fund (XLK) ETF Stock Forecast, Price costs, management fees, performance fees or expenses, if applicable. Please. An easy way to get SPDR Select Sector Fund - Technology real-time prices. View live XLK stock fund chart, financials, and market news. Fund Details ; Fund Type. Sector Equity ; Issuer. SPDR State Street Global Advisors ; Inception. 12/16/ ; Expense Ratio. % ; AUM. $B. XLK | A complete Technology Select Sector SPDR ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. The Technology Select Sector SPDR® ETF (XLK). + (+%) USD | NYSEARCA | Aug 23, + (+%) After-Hours: Switch to. XLK tracks an index of S&P technology stocks. XLK was the first to launch in this space, as such it offers a more narrow focus on the US technology segment.

This ETF provides physical exposure, by owning its shares you earn the return of the securities composing the index (as the ETF holds them directly). Dividend. NVIDIA Corp. $ NVDA ; Invesco QQQ Trust, Series 1. $ QQQ ; Invesco NASDAQ ETF. $ QQQM ; Financial Select Sector SPDR Fund. $ XLF. What is ETF correlation? Correlation is a measure of the strength of the relationship between two ETFs. It quantifies the degree to which prices of the two ETFs. Commission-free trading refers to $0 commissions charged on trades of US listed registered securities placed during the US Markets Regular Trading Hours in self. XLK has a net expense ratio of %. View detailed historical fee data for XLK on Tiingo. The Technology Select Sector SPDR Fund (XLK) is an exchange-traded fund that is based on the Technology Select Sector index. The fund tracks an index of S&P. * Expense ratio updated annually from fund's year-end report. Investment Policy. The Fund seeks to provide investment results that, before expenses. High portfolio turnover can translate to higher expenses and lower aftertax returns. The Technology Select Sector SPDR® ETF has a portfolio turnover rate of 19%. This ETF provides physical exposure, by owning its shares you earn the return of the securities composing the index (as the ETF holds them directly). Dividend. XLK ETF Stock Price History ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: The XLK ETF provides physical exposure, so by buying it you actually own parts of all the 65 underlying holdings. This share class generates a stream of income. Key Stats · Expense Ratio % · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change · 1 Year % Change Top 10 Holdings (% of Total Assets) · Sector Weightings · Overall Portfolio Composition (%) · Equity Holdings · Bond Ratings · ETF Summary · ETF Overview. ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage. * Expense ratio updated annually from fund's year-end report. Investment Policy. The Fund seeks to provide investment results that, before expenses. All Holdings. as of 08/15/ Holdings are subject to change. Schwab ETF Holdings Chart. Key Fund Data ; Yield. % ; Net Expense Ratio. % ; Turnover %. 19% ; Portfolio Style. Science & Tech ; Inception Date. December 16, Other Expenses, %, % ; Total Expense, %, % ; Fee Waiver, %, % ; Net Expense, %, %. There are 67 companies in the Technology Select Sector SPDR. XLK. FUND DETAILS. PERFORMANCE AS OF 6/30/ Trading Symbol. XLK. NVIDIA Corp. $ NVDA ; Invesco QQQ Trust, Series 1. $ QQQ ; Invesco NASDAQ ETF. $ QQQM ; Financial Select Sector SPDR Fund. $ XLF.

What Crm Does Google Use

Salesmate stands out as the best CRM for Gmail due to its robust CRM, Gmail integration, and comprehensive CRM tools. Whether you're looking to manage customer. Share data easily between Sugar's CRM software and your favorite Google apps. Leverage standard and custom Google Workspace CRM integrations. The answer is no — Google is not a company that develops its own CRM software. However, a number of small businesses use Google Workspace tools like Gmail. Google Workspace, the cloud software that enterprises love to use, includes many collaboration functions that are required for work and business but are yet. Streak was awarded the Google Technology Partner of the Year, in recognition of our fully integrated CRM and deep, powerful integration with all of G Suite -. When should you use a G Suite CRM? · The Best G Suite CRMs: Streak and NetHunt · Best integrations for full-size CRMs · The Best CRMs that Integrate with G Suite. Discover how you can use Google Workspace (formerly G Suite) as the perfect CRM to manage your relationships with your customers and more. 10 CRM available on Google Workspace Marketplace · 1. Zoho CRM · 2. Capsule CRM · 3. Salesmate CRM · 4. Pipeline · 5. Insightly · 6. Nutshell CRM · 7. Pipeliner CRM · 8. CRM in Google is an overarching term used to describe CRM tools that integrate with applications in Google Workspace. Salesmate stands out as the best CRM for Gmail due to its robust CRM, Gmail integration, and comprehensive CRM tools. Whether you're looking to manage customer. Share data easily between Sugar's CRM software and your favorite Google apps. Leverage standard and custom Google Workspace CRM integrations. The answer is no — Google is not a company that develops its own CRM software. However, a number of small businesses use Google Workspace tools like Gmail. Google Workspace, the cloud software that enterprises love to use, includes many collaboration functions that are required for work and business but are yet. Streak was awarded the Google Technology Partner of the Year, in recognition of our fully integrated CRM and deep, powerful integration with all of G Suite -. When should you use a G Suite CRM? · The Best G Suite CRMs: Streak and NetHunt · Best integrations for full-size CRMs · The Best CRMs that Integrate with G Suite. Discover how you can use Google Workspace (formerly G Suite) as the perfect CRM to manage your relationships with your customers and more. 10 CRM available on Google Workspace Marketplace · 1. Zoho CRM · 2. Capsule CRM · 3. Salesmate CRM · 4. Pipeline · 5. Insightly · 6. Nutshell CRM · 7. Pipeliner CRM · 8. CRM in Google is an overarching term used to describe CRM tools that integrate with applications in Google Workspace.

Streak and Nethunt offer sales people and small businesses the key functionality of CRM in an easily-accessible format inside the G Suite tools they're already. If you are looking out for the best CRM to use with Google, sign up for free. Hundreds of people have integrated their Google accounts with Friday CRM and are. Salesforce is one of the most popular CRMs in the market, and it has a native integration with Google Workspace. You can use the Salesforce. The CCAI Platform CRM package sends multiple pieces of data during a support interaction, and all data interactions that take place in the CRM are assigned to a. Nutshell is the best CRM for Google, and here's why. With the help of marketing automation tools and email templates from Nutshell, you can reach more potential. Setting up UTM tracking is the most straightforward way to connect your CRM data to Google data without any heavy lifting. A UTM is an extension added to your. The cherry on top of all this? By acquiring Hubspot not only does Google boost Ads revenue, revamp Workspace as the next gen CRM, feed Gemini. You can integrate your customer relationship management (CRM) system data sources with Customer Match using Zapier as your integration partner. Zapier. Copper (formerly ProsperWorks) is an easy-to-use CRM system for small businesses that helps them capture contacts and sales leads directly from their Gmail. Zoho CRM integrates seamlessly with Google Workspace to bring all your emails, files, and tasks together in one place thus helping you reduce manual effort. You can use a free CRM and you still integrate with Google Sheets and Zapier if you prefer. It's just if you have forms on your website for ". However, there is a completely free CRM — Friday CRM. It is the ideal CRM for Gmail and G Suite. Collect all mail into an account, create deals with your. The best CRM solutions are not only easier to use than spreadsheets, but they also do more than just retain user and contact information. They also automate. Does Google offer a CRM? Google doesn't offer its own CRM, but you can use Zapier to connect your Google apps to virtually any other CRM you'd like to use. If you're using Google Workspace (formerly known as G Suite), then you're in luck. It allows for the best and most stable integrations with your CRM (if you. Share data easily between Sugar's CRM software and your favorite Google apps. Leverage standard and custom Google Workspace CRM integrations. Google Workspace is a suite of apps from Google which offers a number of tools to communicate and collaborate with colleagues, Read more. CRM software built for G Suite provides businesses of all sizes seamless integration with the many Google tools available. This type of software simplifies your. Google Workspace, the cloud software that enterprises love to use, includes many collaboration functions that are required for work and business but are yet.

Can You Put A Roth Ira In A Trust

Leaving IRA assets to trust, rather than to individual beneficiaries, may be appealing because language in the trust can direct how and when the assets can be. It is limited to IRAs, and there are other exclusions and considerations as well. As part of an estate plan: By contrast, there can be significant tax. If you're planning to use a trust, consult a financial or legal professional who's familiar with the rules. Naming a trust as beneficiary will give you maximum control over your tax-deferred money after you die. That's because the distributions will be paid not to an. Another issue you may encounter when transferring your retirement account to a Trust is that your IRA could present a withdrawal penalty for any amount of money. Who can be an IRA beneficiary? · Your spouse · Your children or grandchildren · Trusts · Charities & other organizations. You can have the trust be the primary beneficiary of your IRA, but there are tax advantages to having one or more individuals as the beneficiary. No age limits: You can contribute to your Roth IRA as long as you have earned income that qualifies. In addition, there is no minimum age requirement to open or. A trust can indeed hold IRA assets and investments. Here's how it works: An IRA owner creates a trust. This trust is named as the beneficiary of the IRA. Leaving IRA assets to trust, rather than to individual beneficiaries, may be appealing because language in the trust can direct how and when the assets can be. It is limited to IRAs, and there are other exclusions and considerations as well. As part of an estate plan: By contrast, there can be significant tax. If you're planning to use a trust, consult a financial or legal professional who's familiar with the rules. Naming a trust as beneficiary will give you maximum control over your tax-deferred money after you die. That's because the distributions will be paid not to an. Another issue you may encounter when transferring your retirement account to a Trust is that your IRA could present a withdrawal penalty for any amount of money. Who can be an IRA beneficiary? · Your spouse · Your children or grandchildren · Trusts · Charities & other organizations. You can have the trust be the primary beneficiary of your IRA, but there are tax advantages to having one or more individuals as the beneficiary. No age limits: You can contribute to your Roth IRA as long as you have earned income that qualifies. In addition, there is no minimum age requirement to open or. A trust can indeed hold IRA assets and investments. Here's how it works: An IRA owner creates a trust. This trust is named as the beneficiary of the IRA.

to a Roth IRA. If you convert a pre-tax amount to a Roth IRA, you will owe taxes for the tax year of the conversion. If you are a non-spouse designated. Qualified tuition program rollover to a Roth IRA. Beginning with distributions made after December 31, , a beneficiary of a section qualified tuition. Establishing beneficiary designations on an IRA account can be a good way of keeping the asset out of probate, but it's important to understand the pros and. Non spouse beneficiaries (e.g. children of Roth IRA owner) cannot make additional contributions to the inherited Roth IRA and cannot combine it with their own. A solution in both cases could be to name a trust as the IRA beneficiary. On the owner's death, the trust would become the legal owner of the IRA and the. Can You Convert an Inherited IRA to a Roth? · Have your own account. You'll need to set up your own Roth IRA in advance. · Pay your taxes up front. Be aware that. It combines the tax benefits of a traditional or Roth IRA with greater control over how your assets are distributed. A Trusteed IRA can be particularly helpful. Money put in a Roth IRA is taxed before it's invested. If you think a Roth IRA is the way to save for your retirement, then it's time for us to chat. The beneficiary may be anyone — a spouse, relative, or an estate or trust, for example. On the other hand, if you inherit a Roth IRA, it may make sense to. Under IRS rules, when you name a trust as beneficiary, the best deal you can get is that assets will be fully taxed over the life of the oldest beneficiary of. A trust arrangement is particularly beneficial for a Roth IRA because you can stretch out payments longer than with a traditional IRA. There's no. Roth IRA trust Additionally, information about Roth. IRAs can be obtained from any district office of the IRS. Right to Revoke. You can revoke your Roth IRA. A participant in a retirement account, whether it is an IRA, (k), , b, Profit Sharing Plan, Defined Benefit Plan, or any other Profit Sharing / Pension. Still, the funds can remain tax deferred, and you can generally withdraw money right away without penalty. However, a designated beneficiary is generally. The beneficiary that has their own inherited Roth will have total control of the investments and the timing of any distributions over the next 10 years. These. If you convert in , you have two years in which to pay the income tax on the conversion and • Benefits of a Roth: o No required. Putting your IRA in a trust can be a great way to protect your privacy and open up your investment options. Learn how to open your own Self-Directed IRA. If your income is too high, you will not be allowed to contribute. The area of cross-border taxation and cross-border investing is complex and may seem. By doing so, Congress allows you to form an IRA Trust for your child that allows the Inherited plan to remain tax-deferred. Because your child does not own the.

J& J Stock Price

J&J | JNJStock Price | Live Quote | Historical Chart ; J&J, , , % ; Eli Lilly, , , %. View the real-time JNJ price chart on Robinhood and decide if you want to buy or sell commission J&J mid-stage trial for lung cancer drug Rybrevant hits main. Open; Day High; Day Low; Prev Close; 52 Week High; 52 Week High Date09/04/24; 52 Week Low; 52 Week Low Date04/18/ Get the latest J & J Snack Foods Corp (JJSF) real-time quote, historical performance, charts, and other financial information to help you make more informed. Johnson & Johnson (pqepny.site): Stock quote, stock chart, quotes J&J Unit Seeks EU Approval for Chronic Neuromuscular Disease Drug. 10h ago MT. J&J has one of the largest research and development (R&D) budget among pharma companies. J&J's worldwide business is divided into three segments. Johnson & Johnson ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: Discover real-time Johnson & Johnson Common Stock (JNJ) stock prices, quotes, historical data, news, and Insights for informed trading and investment. J&J | JNJStock Price | Live Quote | Historical Chart ; J&J, , , % ; Eli Lilly, , , %. View the real-time JNJ price chart on Robinhood and decide if you want to buy or sell commission J&J mid-stage trial for lung cancer drug Rybrevant hits main. Open; Day High; Day Low; Prev Close; 52 Week High; 52 Week High Date09/04/24; 52 Week Low; 52 Week Low Date04/18/ Get the latest J & J Snack Foods Corp (JJSF) real-time quote, historical performance, charts, and other financial information to help you make more informed. Johnson & Johnson (pqepny.site): Stock quote, stock chart, quotes J&J Unit Seeks EU Approval for Chronic Neuromuscular Disease Drug. 10h ago MT. J&J has one of the largest research and development (R&D) budget among pharma companies. J&J's worldwide business is divided into three segments. Johnson & Johnson ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: Discover real-time Johnson & Johnson Common Stock (JNJ) stock prices, quotes, historical data, news, and Insights for informed trading and investment.

Johnson & Johnson Common Stock (JNJ) Historical Quotes Should You Invest in the VanEck Pharmaceutical ETF (PPH)?. 5 hours ago • Zacks. Markets. J&J's. Johnson & Johnson ; Prev. Close. ; Low. ; 52wk Low. ; Market Cap. b ; Total Shares. b. Track Johnson & Johnson (JNJ) Stock Price, Quote, latest community messages, chart, news and other stock related information. JNJ average Analyst price target in the past 3 months is $ Find stocks in the Healthcare sector that are highly recommended by Top Performing Analysts. Johnson & Johnson (NYSE: JNJ). $ (%). $ Price as of September 13, , Decker Robert J, Common Stock. Aug 30, , Sell, , Decker Robert J This move aims to boost J&J's medical device sector, signaling potential. Stock quote · Stock chart · Historical stock quote · Investment calculator The J&J value. At Johnson & Johnson, we believe health is everything. We are. Price, $, Volume, 5,, Change, , % Change, %. Today's open, $, Previous close, $ Intraday high, $, Intraday low. Johnson & Johnson (JNJ) Stock Price & Analysis. Follow. 24, Followers J&J to end some up-front drug discounts for hospitals, WSJ reports. 17d ago. J&J's TREMFYA approved by FDA for treatment of ulcerative colitis by TipRanks Sep 11 pm ET Wells Fargo Sticks to Its Hold Rating for Johnson & Johnson. What Is the J&J (JNJ) Stock Price Today? The J&J stock price today is What Stock Exchange Does J&J Trade On? J&J is listed and trades on the NYSE. J&J · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (+% YoY). Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The. The latest closing stock price for Johnson & Johnson as of September 12, is The all-time high Johnson & Johnson stock closing price was on. Get Johnson & Johnson (JNJ.N) real-time stock quotes, news, price and financial J&J's proposed talc settlement sparks lawsuit between plaintiffs' firms. J&J stock price quote (NYSE: JNJ), historical charts, related news, stock analyst insights and more to help you make the right investing decisions. On Bloomberg Chief Future Officer, Johnson & Johnson CFO Joe Wo 1 day ago - Bloomberg Markets and Finance. How J&J's CFO Keeps His Footing on the 'Patent. Johnson and Johnson (J&J) is a multinational company, which manufactures and sells pharmaceutical products, medical devices and consumer packaged commodities. J&J Eyes Texas as Venue for Next Round of Baby Powder Fight. updated Aug 15, Ho-Hum Stock Close, J&J Clears Lawsuit Hurdle, More. Aug 12, J&J Gets. Johnson & Johnson's market capitalization is $ B by B shares outstanding. Is Johnson & Johnson stock a Buy, Sell or Hold?

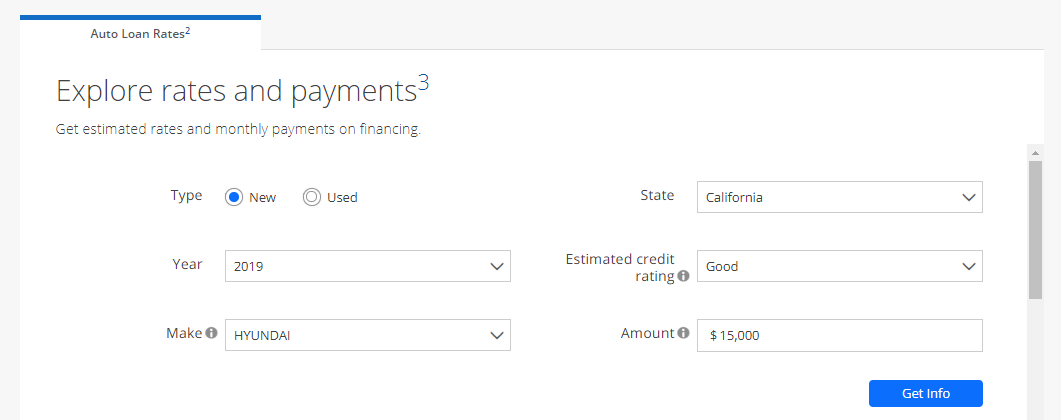

Car Loan Rates Chase Bank

Chase Auto Loan Features · Origination fee: $0 in all states except Indiana, where the origination fee is $ · Prepayment fee: $0 · Discounts: You'll get a %. Preferred Rewards members who apply for an Auto purchase or refinance loan receive an interest rate discount of % for Gold tier, % for Platinum tier. The vehicle you purchase may also affect your interest rate. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles. Drivers typically save an average of $* per month, adding up to $* annually, when they refinance their Chase Bank loan. Chase Bank, N.A. (Chase). JLR is solely responsible for its products and Auto finance accounts are owned by Chase and are subject to credit approval, terms. Datatrac is an independent, unbiased research firm that has monitored deposit and loan rates, fees and product features for over 25 years. As a Chase Private Client, you receive a rate discount of % off standard auto financing rates when you apply through JPMorgan Chase Bank, N.A. ("Chase"). Compare Chase Car Loans ; Chase 72 Month Car Loan · $ · % ; Chase 72 Month Used Car Loan · $ · % ; Chase 60 Month Car Loan · $ · % ; Chase 72 Month. I have an auto loan through Chase (my fifth through them in ten years) at % (with an credit score). Chase Auto Loan Features · Origination fee: $0 in all states except Indiana, where the origination fee is $ · Prepayment fee: $0 · Discounts: You'll get a %. Preferred Rewards members who apply for an Auto purchase or refinance loan receive an interest rate discount of % for Gold tier, % for Platinum tier. The vehicle you purchase may also affect your interest rate. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles. Drivers typically save an average of $* per month, adding up to $* annually, when they refinance their Chase Bank loan. Chase Bank, N.A. (Chase). JLR is solely responsible for its products and Auto finance accounts are owned by Chase and are subject to credit approval, terms. Datatrac is an independent, unbiased research firm that has monitored deposit and loan rates, fees and product features for over 25 years. As a Chase Private Client, you receive a rate discount of % off standard auto financing rates when you apply through JPMorgan Chase Bank, N.A. ("Chase"). Compare Chase Car Loans ; Chase 72 Month Car Loan · $ · % ; Chase 72 Month Used Car Loan · $ · % ; Chase 60 Month Car Loan · $ · % ; Chase 72 Month. I have an auto loan through Chase (my fifth through them in ten years) at % (with an credit score).

During the process chase bank/Rivan offered %, so I applied When the average rate for car loans for consumers is for the. If you're looking to potentially reduce your monthly payments or shorten your repayment term at a more favorable rate, refinancing your car loan may be an. Chase offers two primary savings accounts: Chase Savings℠ and Chase Premier Savings℠. Both have a minimum APY of %. However, you can earn an additional. auto financing rates anywhere else. Our experienced and professional Bank. Bank of America NA. BMO Harris Bank NA. Capital One Auto Finance. CPS Inc. Shop for cars, explore auto financing options and manage your car all within Chase Auto. Learn how you can get started today! Subaru A Lot To Love Event. Special low rates on select new vehicles. Chase Bank, N.A. (Chase). Subaru is solely responsible for its products and. While having an Auto Loan is not fun, Chase made the service enjoyable. Making payments were very easy. I set up auto payments and this worked very well. I. Chase Auto is here to help you get the right car. Apply for auto financing for a new or used car with Chase. Use the payment calculator to estimate monthly. Chase offers two savings accounts that pair with a highly rated mobile banking app to help you achieve your financial goals, but interest rates are next to. Monthly payments are only estimates derived from the vehicle price with a 72 month term, % interest and 20% downpayment. How Chase auto loans compare ; Starting APR, Not disclosed, Varies by location, % ; Loan terms, 12 to 84 months, Varies by location, 48 to 72 months. Origination fee: $0 in all states except Indiana, where the origination fee is $ · Prepayment fee: $0 · Discounts: You'll get a % rate discount if you're a. If you bought your car when interest rates were high, refinancing your Chase Bank, N.A. product or service. Outlooks and past performance are not. chase bank logo, Dealership purchases, Not specified, months, From $4,, See Personalized Results. Learn more about how we chose the best auto loans. Chase offers auto loans to buy either a new or used vehicle from a dealership. Terms range from four to eight years with APR rates as low as %. Let's go into more detail on how your credit score can impact your car loan. Car loan rates by credit score. When you apply for a car loan, auto dealers may. Your monthly payment will be determined by the vehicle cost, loan term and APR (annual percentage rate) — which is highly dependent on your credit score. The. Compare Auto Loan Rates ; US Bank, % ; Chase Bank, % ; Regions, % ; PNC Bank, % ; Truist, %. This is the worst company ever. Will NEVER have a loan with them again. They have zero customer service. FYI they will never contact you if there is a reversed. But what if you could get a 0% interest rate? While you may think it's too good to be true, 0% APR car deals are quite common. Dealerships and car manufacturers.

Is It Worth To Buy Points On Mortgage

Typically, you would buy points to lower your interest rate on a fixed-rate mortgage. Buying points for adjustable rate mortgages only provides a discount. Always pay attention to advertised loan rates, as most show an interest rate based on the purchase of a certain number of discount points, which must be paid at. Buying points is a great way to get a better interest rate and more manageable monthly payments, but if you're currently in the home purchase process and. With a larger down payment, the income is the reduction in monthly payment that results from the smaller loan and mortgage insurance premium. With points, the. While you will pay more upfront with points, you will pay less over the life of the loan due to the discounted interest rate, making points a good option for. Mortgage points are also referred to as 'buying down the rate' or 'discount points.' One point is equal to one percent of the starting loan balance. Buying mortgage points can help you earn a lower interest rate on your mortgage. Having a lower rate, in turn, helps you save money over the life of the loan. Use the mortgage points calculator to see how buying points can reduce your interest rate, which in turn reduces your monthly payment. Did you know you can use mortgage points to buy down your interest rate? Mortgage points — a.k.a. discount points — are upfront fees a borrower pays a lender to. Typically, you would buy points to lower your interest rate on a fixed-rate mortgage. Buying points for adjustable rate mortgages only provides a discount. Always pay attention to advertised loan rates, as most show an interest rate based on the purchase of a certain number of discount points, which must be paid at. Buying points is a great way to get a better interest rate and more manageable monthly payments, but if you're currently in the home purchase process and. With a larger down payment, the income is the reduction in monthly payment that results from the smaller loan and mortgage insurance premium. With points, the. While you will pay more upfront with points, you will pay less over the life of the loan due to the discounted interest rate, making points a good option for. Mortgage points are also referred to as 'buying down the rate' or 'discount points.' One point is equal to one percent of the starting loan balance. Buying mortgage points can help you earn a lower interest rate on your mortgage. Having a lower rate, in turn, helps you save money over the life of the loan. Use the mortgage points calculator to see how buying points can reduce your interest rate, which in turn reduces your monthly payment. Did you know you can use mortgage points to buy down your interest rate? Mortgage points — a.k.a. discount points — are upfront fees a borrower pays a lender to.

(This applies only to new mortgage loans. If you are buying points to refinance your home, the IRS considers this prepaid interest. That means you will have. Use the mortgage points calculator to see how buying points can reduce your interest rate, which in turn reduces your monthly payment. % and%. It's also worth keeping in mind that mortgages with points carry a lower interest rate but have higher closing costs since points are paid at. For example, on a $, loan, one point would be $1, Learn more about what mortgage points are and determine whether “buying points” is a good option for. The money you pay up front to buy points will lower your monthly mortgage payments, but it will take a while for those savings to equal the amount you paid. You pay a lump sum at closing in exchange for a lower interest rate on your home loan. Points allow you to spend more now to save later, which is good if you. As we've mentioned before, mortgage points won't always be worth buying. As a matter of fact, their high costs are enough to steer most home buyers away. Even. Paying points on a mortgage means that if you plan on living in your new home for a long time, you will most likely save money over the life of the loan. · It. These points enable you to secure a lower interest rate when buying a home. Moreover, it results in long-term savings on your loan. Read our guide to understand. The amount you can save on your interest rate by paying for points will vary by lender. However, for each loan point you purchase, you can typically reduce the. Buying points to lower your monthly mortgage payments may make sense if you select a fixed-rate mortgage and plan on owning. Not only can purchasing mortgage points lower your monthly mortgage payment when interest rates are high, you can also potentially save thousands of dollars. (This applies only to new mortgage loans. If you are buying points to refinance your home, the IRS considers this prepaid interest. That means you will have. A: Mortgage points are also known as discount points. It's basically prepaid interest on your loan— in other words, points let you make a trade-off between what. Mortgage points can help homeowners lower their interest rate. Learn what mortgage points are, how much they cost, and if you should buy them. Buying mortgage points—also called “discount points”—is a simple way to potentially save thousands over the life of your loan. Here's why it could make sense to. For some people, buying mortgage points can be a great way to reduce long-term interest costs. However, it's essential to consider your break-even point to see. Many people refer to the purchase of mortgage points as “buying down the rate.” Essentially, when you buy a mortgage point, you pay some of your loan interest. If you're looking for the lowest home loan rate possible, paying mortgage points may be worth the cost, if you understand the pros and cons. Buying mortgage points when you close can reduce the interest rate, which in turn reduces the monthly payment. But each point will cost 1 percent of your.

Average Cost Of Liability Car Insurance

Liability insurance prices vary by state, insurer, and driver, but the national average rate for a liability-only or minimum coverage policy is about $ First you input the model of your car, the make and year. Also add the average commute distance you drive. Ontario car insurance calculator step pqepny.site Who. In Texas, the average annual cost stands at $2, for full coverage car insurance, while minimum coverage averages at $ Find quotes for your area. High-risk drivers may face costs ranging from $2, to $5, or more annually. Luxury and High-Performance Vehicles – If you own a luxury or high-performance. Liability Coverage. If you injure someone or damage property, payments are made on your behalf. · Uninsured Automobile Coverage. Medical costs and damage are. Ah, determining the cost of liability insurance for a small business in Ontario is akin to asking how much a car might cost – it can vary widely. On average, a. The price of your car insurance depends on the insurer you choose. In , RATESDOTCA drivers saved an average of $ and $ annually in Ontario and Alberta. How much does liability coverage cost? It ranges in price based on your coverage limits. How much liability insurance do I need? While most states require. Just covers Liability and Injury Coverage. (25k per LA county is littered with personal injury attorneys which drives the price high. Liability insurance prices vary by state, insurer, and driver, but the national average rate for a liability-only or minimum coverage policy is about $ First you input the model of your car, the make and year. Also add the average commute distance you drive. Ontario car insurance calculator step pqepny.site Who. In Texas, the average annual cost stands at $2, for full coverage car insurance, while minimum coverage averages at $ Find quotes for your area. High-risk drivers may face costs ranging from $2, to $5, or more annually. Luxury and High-Performance Vehicles – If you own a luxury or high-performance. Liability Coverage. If you injure someone or damage property, payments are made on your behalf. · Uninsured Automobile Coverage. Medical costs and damage are. Ah, determining the cost of liability insurance for a small business in Ontario is akin to asking how much a car might cost – it can vary widely. On average, a. The price of your car insurance depends on the insurer you choose. In , RATESDOTCA drivers saved an average of $ and $ annually in Ontario and Alberta. How much does liability coverage cost? It ranges in price based on your coverage limits. How much liability insurance do I need? While most states require. Just covers Liability and Injury Coverage. (25k per LA county is littered with personal injury attorneys which drives the price high.

1k deductible on the car. Through state farm. I had travelers prior but they hiked the price significantly recently. Liability, and more. That's it. No strings attached. Trying to figure out how much car insurance will cost you? Get a free car insurance quote online in. Third Party Liability Coverage: This coverage will cover costs for In Toronto, the average cost of car insurance for a driver that has been. Very nice auto insurance The price is very attractive. The broker is very nice and professional. TrustPilot Stars 1 month ago. Fengfeng Zhou. I haven't. The state average for the minimum liability insurance coverage in Texas is $ per year – or $55 monthly. This amount is about $ more expensive than the. If you choose Optional products such as Collision, Comprehensive or Extended Third Party Liability, this will add to what you pay. Cost insurance - vehicle. The. How market conditions impact auto insurance rates. Like any product market conditions affect the price of auto insurance. Inflation is one of many factors. the price the vehicle manufacturer has suggested for a vehicle. It is a realistic price for the vehicle but it is not necessarily the market price. Dealers. Plus, we have the tools and knowledge to find you the best price available for your unique insurance needs. Related Posts. The average full-coverage insurance cost for medium sedans was $1,, compared with $1, for a medium SUV. The average insurance cost for all vehicles. Based on the Insurance Bureau of Canada data, the average annual cost of car insurance premiums is $2, This works out to about $ per month. The price is. Your responses will help you get the right level of protection for a great price. Learn more about factors that impact your car insurance coverage needs. The. The average rate was $80 per month. So what can you expect to spend? The median price reflects what most people pay for business liability insurance because. The average car insurance rate in Florida is $1, per year — % more than the U.S. average. But auto insurance prices are dictated by factors other than. Which insurance company has the cheapest liability insurance rates? ; $ · $ · $ · $ How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. The average cost is determined to be around dollars a month in Although as mentioned above the actual price calculated for an individual's car. The state average for the minimum liability insurance coverage in Texas is $ per year – or $55 monthly. This amount is about $ more expensive than the. Average Cost of Car Insurance by State ; Oklahoma. $ $ ; Oregon. $ $ ; Pennsylvania. $ $ ; Rhode Island. $ $

Are Mortgage Rates Expected To Increase Or Decrease

The good news is they are expected to change course in , giving prospective homebuyers and those looking to refinance a slight break. In general, rising interest rates curb inflation while declining interest rates tend to speed inflation. When interest rates decline, consumers spend more as. With July's inflation decline toeing the line, we should see cuts at each remaining rate date for , and resume a downward trend through Q1 of The size. For now, that leaves the central bank's benchmark interest rate between % and %, where it has remained since July , and which marks its highest. For potential homebuyers, a Fed rate hike typically leads to an increase in mortgage rates in the early stages of a tightening cycle; however, if the. On November 17, , Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is. Mortgage rates are expected to decrease by nearly 1% by year's end — from % down to as little as % — according to recent housing forecasts. The most optimistic estimate is a drop of per cent to per cent. Lower mortgage rates increase homebuying budgets. Homebuyers rejoice at lower. Mortgage rates today should remain in their narrow range, with some downward pressure. Rising treasury bond yields partially caused the small interest rate. The good news is they are expected to change course in , giving prospective homebuyers and those looking to refinance a slight break. In general, rising interest rates curb inflation while declining interest rates tend to speed inflation. When interest rates decline, consumers spend more as. With July's inflation decline toeing the line, we should see cuts at each remaining rate date for , and resume a downward trend through Q1 of The size. For now, that leaves the central bank's benchmark interest rate between % and %, where it has remained since July , and which marks its highest. For potential homebuyers, a Fed rate hike typically leads to an increase in mortgage rates in the early stages of a tightening cycle; however, if the. On November 17, , Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is. Mortgage rates are expected to decrease by nearly 1% by year's end — from % down to as little as % — according to recent housing forecasts. The most optimistic estimate is a drop of per cent to per cent. Lower mortgage rates increase homebuying budgets. Homebuyers rejoice at lower. Mortgage rates today should remain in their narrow range, with some downward pressure. Rising treasury bond yields partially caused the small interest rate.

Mortgage Bankers Association (MBA). The Mortgage Bankers Association (MBA) predicts that mortgage rates will gradually decrease throughout They forecast. How to protect yourself against rising mortgage rates. Several factors affect mortgage rates, including amortization period, market conditions and the key rate. We expect the overnight interest rate to decline between % to 2% from its peak by the end of The long-term trend of declining yields has ended and we. Industry forecasts indicate a decline in mortgage rates but can be good news and music to your ears if you're a prospective buyer or are looking to refinance. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Rising Mortgage Rates Could Cost Homebuyers Average of Nearly $44, Over Lifetime of Loans · Key findings · States where mortgage payments increased the least. With the first base rate cut announced in August, mortgage rates are expected to fall. As a general rule: if interest rates fall, the mortgage rate forecast. The average contract interest rate for year fixed-rate mortgages with conforming loan balances ($, or less) decreased to % in the week ended August. Economists anticipate that any decline in interest rates from their current levels will likely be slow and won't reach the particularly low rates seen before. That means despite the slight rise in inflation this month, rates are still predicted to fall by the end of the year – although only to %. Analysis by. Meanwhile, the current average rate for a year fixed-rate mortgage is %. What happens when the Fed increases or decreases interest rates. The FOMC. The good news is they are expected to change course in , giving prospective homebuyers and those looking to refinance a slight break. The Fed's decision to raise the benchmark interest rate can influence the average rate for mortgages. Not just that, but it also increases the rate for any. “ will be a better year for the California housing market for both buyers and sellers as mortgage interest rates are expected to decline next year,” said. BMO reports rising mortgage delinquencies and loan loss provisions in Q3. High interest rates drove BMO's mortgage delinquency rate higher in the third quarter. The higher the inflation rate, the more interest rates are likely to rise. This lending, and the interest rates decrease. When the government sells. For now, that leaves the central bank's benchmark interest rate between % and %, where it has remained since July , and which marks its highest. The best answer I can give you to your question is that you can expect prices to rise when interest rates go down because people who've been on. It seems very unlikely that mortgage rates will drop to 6% by the end of Presently REPO Rate is % at which RBI lends money to banks. The impact of interest rate increases is being felt throughout the housing market as sales volumes have decreased. It's predicted that the drop in home.

Top Altcoins To Invest In

We are here to help by providing insights into the best crypto choices for current market conditions. Read on for our top picks of the best crypto to buy now! 6 of the Best Cryptocurrencies to Buy Now · Bitcoin (BTC) · Ether (ETH) · Solana (SOL) · Avalanche (AVAX) · Pepe (PEPE) · Cardano (ADA). The key to finding the best altcoins on is to conduct thorough research which can include looking at a coin's market cap, use cases, team, road map and more. Follow this list to discover and track Cryptocurrencies which have the highest trading volume in all currencies. This list is generated dynamically with the. The key to finding the best altcoins on is to conduct thorough research which can include looking at a coin's market cap, use cases, team, road map and more. Top 5 Altcoins For 10–x Returns · 1. Fantom ($FTM) · 2. PEPE ($PEPE) · 3. Shiba Inu ($SHIB) · 4. Chainlink ($LINK) · 5. Apu Apustaja ($APU) · 4. We are here to help by providing insights into the best crypto choices for current market conditions. Read on for our top picks of the best crypto to buy now! 1. Ethereum (ETH): Widely seemed because the king of altcoins, Ethereum keeps to dominate the decentralized finance (DeFi) area with its clever. I've handpicked a list of the most promising crypto assets that are often considered by many traders to be the best cryptos for short-term gains. We are here to help by providing insights into the best crypto choices for current market conditions. Read on for our top picks of the best crypto to buy now! 6 of the Best Cryptocurrencies to Buy Now · Bitcoin (BTC) · Ether (ETH) · Solana (SOL) · Avalanche (AVAX) · Pepe (PEPE) · Cardano (ADA). The key to finding the best altcoins on is to conduct thorough research which can include looking at a coin's market cap, use cases, team, road map and more. Follow this list to discover and track Cryptocurrencies which have the highest trading volume in all currencies. This list is generated dynamically with the. The key to finding the best altcoins on is to conduct thorough research which can include looking at a coin's market cap, use cases, team, road map and more. Top 5 Altcoins For 10–x Returns · 1. Fantom ($FTM) · 2. PEPE ($PEPE) · 3. Shiba Inu ($SHIB) · 4. Chainlink ($LINK) · 5. Apu Apustaja ($APU) · 4. We are here to help by providing insights into the best crypto choices for current market conditions. Read on for our top picks of the best crypto to buy now! 1. Ethereum (ETH): Widely seemed because the king of altcoins, Ethereum keeps to dominate the decentralized finance (DeFi) area with its clever. I've handpicked a list of the most promising crypto assets that are often considered by many traders to be the best cryptos for short-term gains.

I've handpicked a list of the most promising crypto assets that are often considered by many traders to be the best cryptos for short-term gains. Discover the best altcoins for Top cryptocurrencies include Ethereum, Cardano, Solana, Polkadot, and Chainlink. Bitcoin, ETH & Solana: Top 3 coin according to Market cap are probably the best to buy & hodl at the moment for the long term. Other important coins include Litecoin (LTC), Chainlink (LINK), Cosmos (ATOM), and Monero (XMR). Why Is Bitcoin Still the Most Important Cryptocurrency? Despite. Bitcoin (BTC) retains its position as the leading cryptocurrency by market cap, and its dominance garners attention from investors. The graph also reveals. 8 best altcoins in · 1. Ethereum (ETH). Market cap: $ billion. 1-year return: 77% · 3. Solana (SOL). Market cap: $ billion. 1-year return: % · 5. Ethereum is the largest and most important altcoin, as it powers many tokens and decentralized applications and dominates the decentralized finance space (DeFi). Top 10 Altcoins for · EOS · Ripple?-?XRP · Stellar?-?XLM · Zcash?-?ZEC · 0x?-?ZRX · Basic Attention Token?-?BAT · Tron?-?TRX · Ethereum Classic?-?ETC. In this article, we will discuss the 10 best altcoins to invest in before it goes to the moon. What are the best long-term cryptocurrencies? · Bitcoin · Ethereum · Chainlink · Polkadot · Cardano · Avalanche · Aave. The best altcoins to invest in are Ether (ETH), XRP (XRP) and BNB Coin (BNB). This information prepared by capex. The oldest and most popular crypto token on the market, Bitcoin was the coin that started the entire crypto craze. From its humble beginnings in , it has. Which Altcoins Are Worth Your Investment? · Cosmos – Altcoin With The Best Interoperability Functionality · The Sandbox – Best Altcoin To Invest In The Metaverse. Bitcoin is considered the best cryptocurrency to invest in long-term due to its widespread adoption, scarcity, and strong track record as a store of value. In this article, we will discuss the 10 best altcoins to invest in before it goes to the moon. Comparison Table Best Altcoins to Invest in · #1) Ethereum · #2) Solana (SOL) · #3) Binance Coin or BNB · #4) Polygon MATIC · #5) Uniswap (UNI) · #6) Cardano. In conclusion, ETFSwap (ETFS) emerges as the top altcoin for investors to focus on in July Its presale, currently offering tokens at a devalued price of. In , all eyes will be on altcoins whose value can increase exponentially and bring high returns to investors. 10 best altcoins to invest in. This guide will explain what are altcoins, how to invest in altcoins, and how altcoins work. Also, we will show how different ways to buy altcoins. The experts at TU have listed down the 15 best altcoins that have the highest potential to grow in

No Interest Credit Cards For 18 Months

Some credit cards offer an introductory period – often 12 to 18 months – with 0% interest on purchases and, potentially, balance transfers. These cards can help. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Save on interest. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. 3% Intro Balance Transfer. Save money on interest and apply for a Bank of America® credit card with a low intro APR on purchases. Find a top zero-interest credit card in to help finance big purchases and manage debt without paying interest with Bankrate. Visa® Signature · 0% APR for the first 18 months (variable % or % APR after the introductory period) · Unlimited % cash back on every purchase · No. 0% Intro APR for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that's. Some credit cards offer an introductory period – often 12 to 18 months – with 0% interest on purchases and, potentially, balance transfers. These cards can help. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Save on interest. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. 3% Intro Balance Transfer. Save money on interest and apply for a Bank of America® credit card with a low intro APR on purchases. Find a top zero-interest credit card in to help finance big purchases and manage debt without paying interest with Bankrate. Visa® Signature · 0% APR for the first 18 months (variable % or % APR after the introductory period) · Unlimited % cash back on every purchase · No. 0% Intro APR for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that's.

0% Intro APR Card Offers (5) ; Blue Cash Everyday® Card. No Annual Fee · 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) ; Blue Cash. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. The Citi® Double Cash Card - 18 month BT offer is a great option for a 0% APR card, even though it only applies to balance transfers. Consumer credit cards that. Consumer Credit Card · 6-month everyday financing** on purchases of $ or more. · 1 year to make returns. See The Home Depot Returns Policy for details. · Zero. Long 0% intro for balance transfers, 21 months: U.S. Bank Visa Platinum Card; Best month 0% intro offer: BankAmericard credit card; Runner-up, month 0%. For example, you might have 0% interest for 18 months on balance transfers made up to the first 90 days from account opening. Any transfers made later would. No foreign transaction fees**. Intro Offers: Save more with a 0 0% intro APR on purchases for the first 18 months following account opening. Take advantage of no interest payments. Get matched to intro 0% APR credit cards from our partners based on your unique credit profile. Our best balance transfer offer: 0% intro APR for first 18 billing cycles after account opening. After that, %–% variable APR based on your. interest for a certain introductory period. Typically, this period lasts between 12 and 18 months, though some cards offer even more time than this to pay. Thank you! Do you have any recommendations on a good no interest credit card? 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Citi Simplicity® Credit Card · Low intro APRon purchases for 12 months · Low intro APRon balance transfers for 21 months · No annual fee. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. Citi Simplicity® Credit Card · Low intro APRon purchases for 12 months · Low intro APRon balance transfers for 21 months · No annual fee. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. No interest if paid in full within 18 months* on Yardbird purchases $ and up when you use your My Best Buy® Credit Card. Interest will be charged to your. Visa® Signature · 0% APR for the first 18 months (variable % or % APR after the introductory period) · Unlimited % cash back on every purchase · No. Limited time: No interest if paid in full within 18 months* on storewide purchases $ and up when you use your My Best Buy® Credit Card. Interest will be.